Financial Plus is an interest rate comparison site that provides customized information by identifying the conditions of users and the conditions of additional mortgage loans that vary depending on what they want to use

if you know anything in the meantime

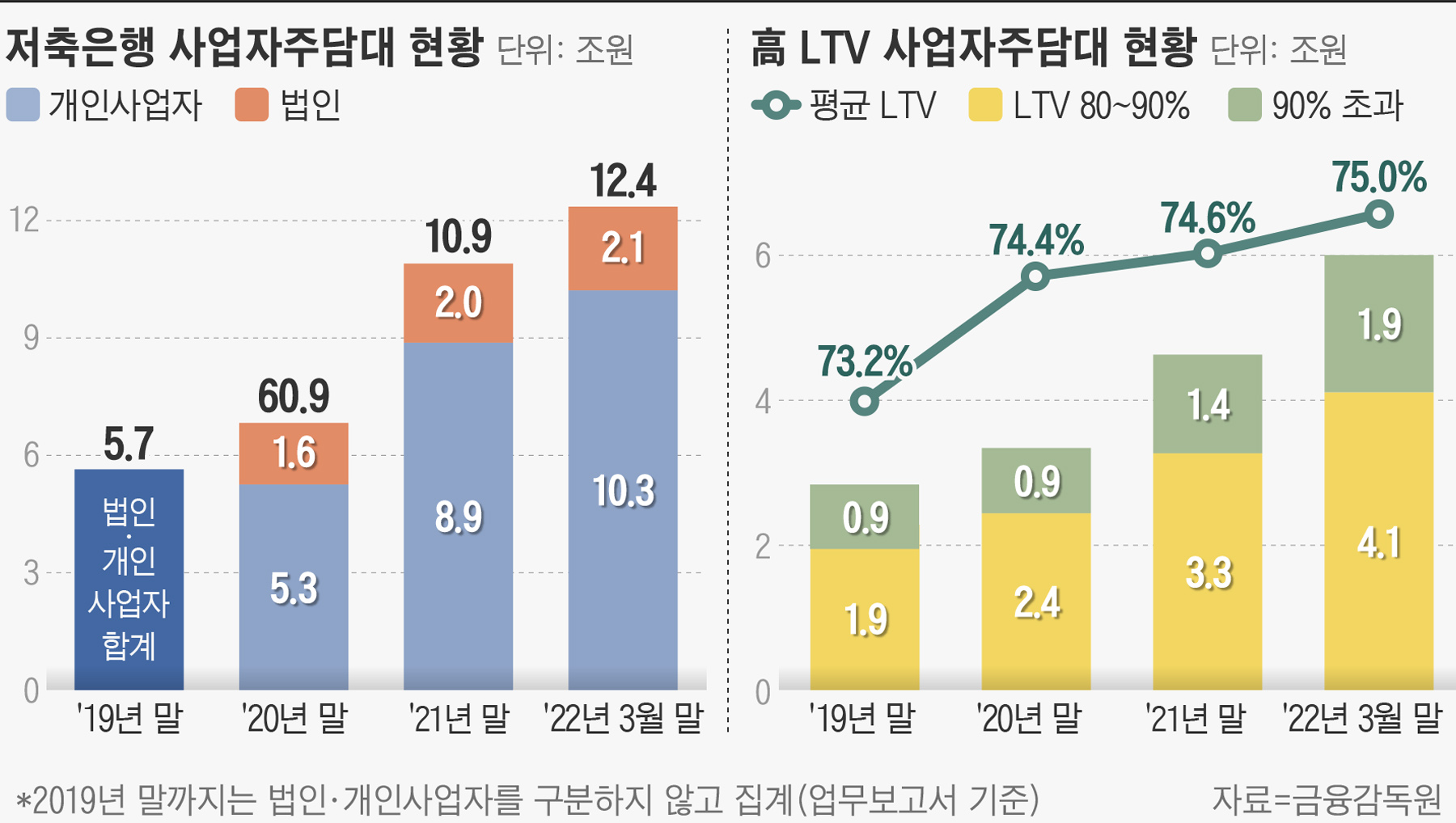

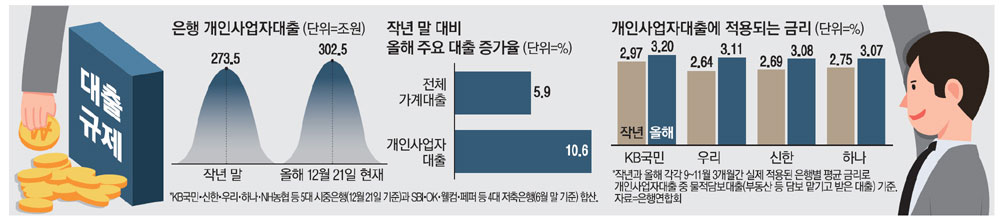

It’s advantageous to do this at a private savings bank…it’s like the official word, and it’s not only because of dsr regulations, but also because of the rise in procurement rates, and the rejection rate of additional funds is high for low-credit sole proprietors

– Related Articles Posted Today

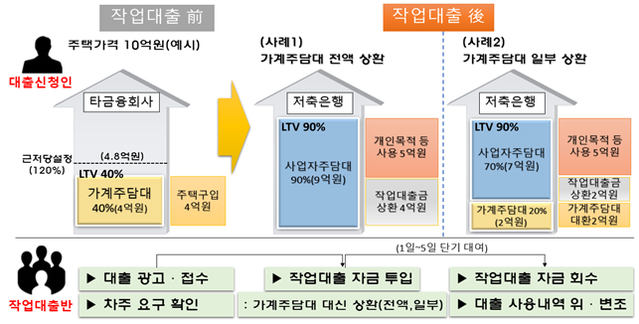

900,000,000 apartments for low-credit individuals with credit scores of 500 points in the third place of sole proprietors who need additional business funds while using savings banks

Insurance Company Collateral KRW 450 million Annual 2.94% Savings Collateral KRW 18 million Annual 7.9% Savings Bank Credit KRW 12 million Annual 18.9% Capital Credit KRW 34 million Annual 17.9% Card Loan 14.8%

We are already operating additional business funds through savings banks, but we have to refuse additional mortgage loans for low-credit private businesses because we are already using them

Insurance company collateral KRW 450 million/year 2.94% Savings collateral KRW 180 million/year 7.9%/year Additional housing KRW 72 million/year 11.5%

Successful use of KRW 72,000,000 interest rate 11.5% in 3 financial sectors through confirmation of low-credit sole proprietor financial plus rejected by savings banks, raising KRW 12 million and saving KRW 2,146,000 annually after lending to the sole proprietor

In other words, additional mortgage loans for low-credit private business apartments are not absolutely impossible to use even if they are already in use. However, there may be differences in methods such as convergence rather than additional debt diagnosis.comparison of free interest rates

Previous image Next image

Previous image Next image

Previous image Next image